maine property tax calculator

Any homeowner can estimate the individual impact of the referendum by multiplying their 2016 Maine Township High School District 207 taxes paid on their 2016 tax bill b y 1296. What Is Property Tax.

Municipal Services and the Unorganized Territory.

. The benefit for this credit for single filers is 750 depending on filing status and the number of exemptions claimed. Maine Income Tax Calculator 2021. Property Tax By State.

If you make 70000 a year living in the region of Maine USA you will be taxed 12188. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Property Tax Division is divided into two units.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The median property tax on a 24840000 house is 270756 in Maine. For comparison the median home value in York County is 23330000.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Please contact our office at 207-624-5600 for further information on any of the following.

Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more accurate estimates for an individual property. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Your average tax rate is 1198 and. Excise tax is an annual tax that must be paid prior to registering your vehicle. This unit is responsible for providing technical support to municipal assessors taxpayers legislators and other governmental agencies.

The median property tax on a 24840000 house is 260820 in the United States. In terms of median property tax payments New Hampshires property taxes also rank among the top three in the nation. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. These rates apply to the tax bills that were mailed in August 2021 and due October 1. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property.

In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations. Figure out your filing status. The Municipal Services Unit is one of two areas that make up the Property Tax Division.

For comparison the median home value in Maine is 17750000. The transfer tax is collected on the following two transactions. After a few seconds you will be provided with a full breakdown of the tax you are paying.

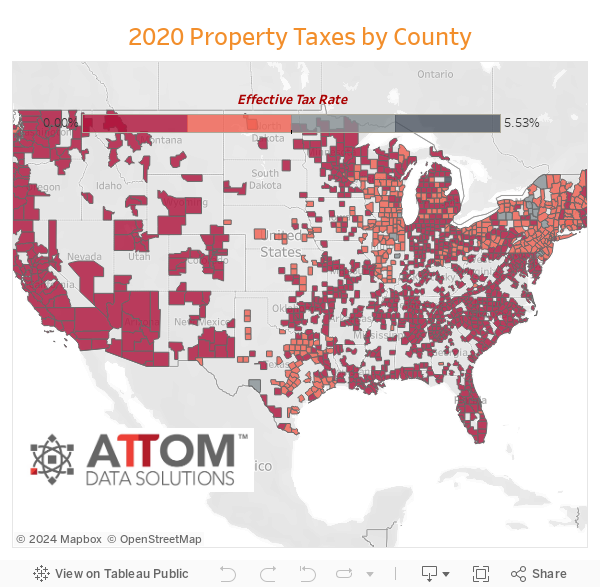

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Cumberland County. The following is a list of individual tax rates applied to property located in the unorganized territory. However it makes up for it with its property taxes as it boasts the fourth-highest property tax rate in the US.

This means that the applicable sales tax rate is the same no matter where you are in Maine. The tax is imposed ½ on the grantor ½ on the grantee. The median property tax homeowners in New Hampshire pay is 5768.

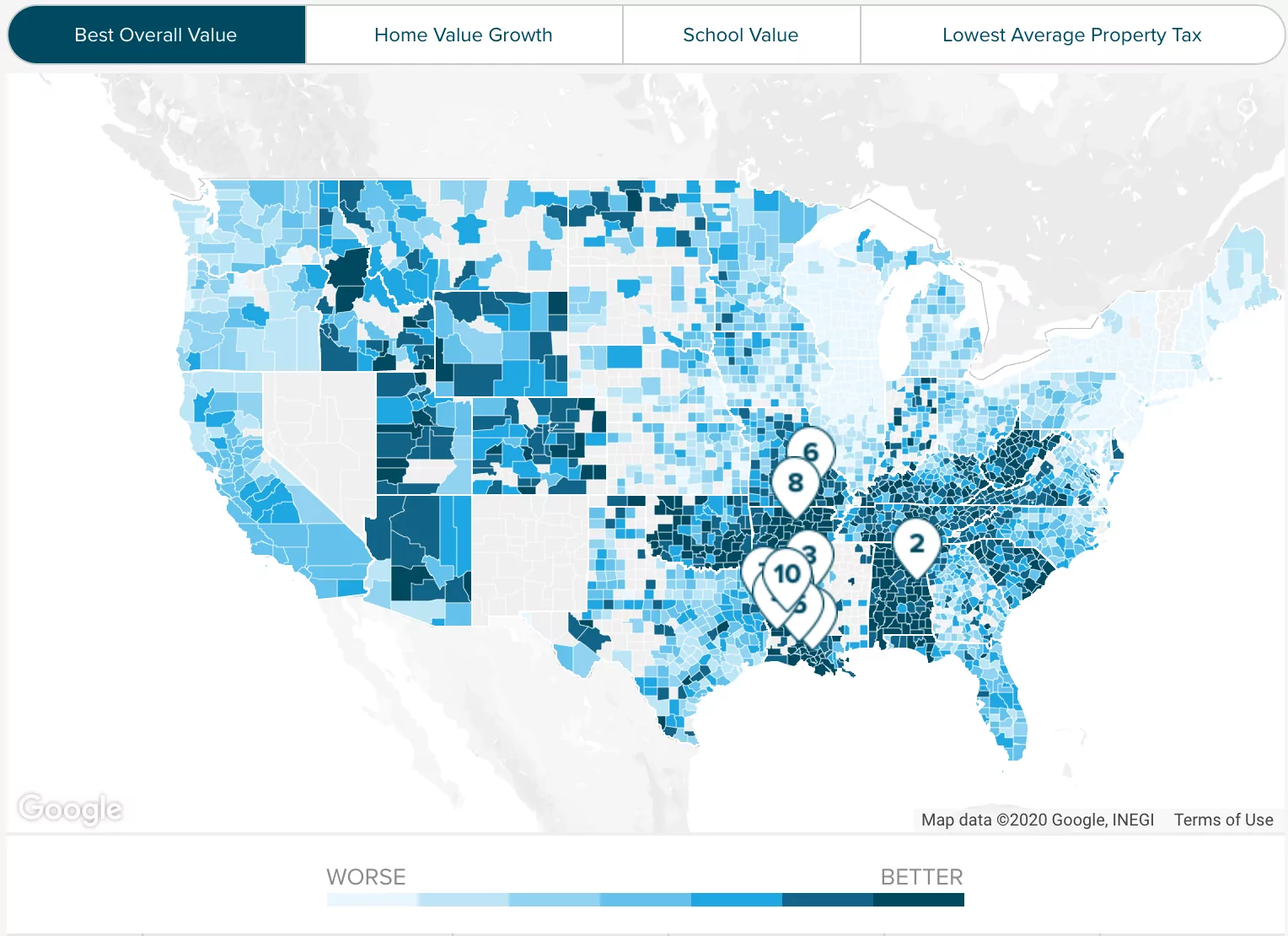

Property Tax By State. Controlling Interest - A separate ReturnDeclaration must be filed for each. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The Maine Property Tax Fairness Credit is available to low-income homeowners who paid property tax on a primary residence in the past year. Find My Tax Assessor. The state valuation is a basis for the allocation of money.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the York County Tax. County Tax Assessors. See Results in Minutes.

Based upon recent home value information from Redfin. Find My Tax Assessor. Calculating your Maine tax year income tax is similar to the steps we outlined on our Federal paycheck calculator.

Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. The impact of the referendum will be determined for each homeowner based upon the assessed value of their property.

The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. Enter Any Address Receive a Comprehensive Property Report. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. Maine has a number of tax credits that benefit taxpayers in certain situations. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to.

Ad Property Taxes Info. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The rate of tax is 220 for each 500 or fractional part of 500 of the value of the property being transferred.

Deducting Property Taxes H R Block

Are There Any States With No Property Tax In 2022

Riverside County Ca Property Tax Calculator Smartasset

Property Taxes By State 2017 Eye On Housing

2013 New Hampshire Tax Rates For Lakes Region Town Sorted By Town And By Rate New Hampshire Town Names Winnipesaukee

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State 2017 Eye On Housing

Maine Property Tax Rates By Town The Master List

Paradym Fusion Viewer Beautiful Lakes Property Tax Boat Storage

Walmart Lowe S Among Big Retailers Scheming To Avoid Maine Property Taxes Beacon Property Tax Walmart Tax

2022 Property Taxes By State Report Propertyshark

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

What Is A Homestead Exemption And How Does It Work Lendingtree

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)